Checkr Trust helps you verify identities and screen for criminal history in real time, so you can make smarter decisions before risk turns into loss.

Why it matters

KYC isn’t enough to catch real risk.

Traditional identity checks can show you who someone is, but not what they’ve done. Over half of fraud offenders have prior convictions, but ID checks and watchlists won’t catch them. Checkr Trust adds real-time criminal data to your verification process and risk stack so you can prevent fraud, stay compliant, and protect revenue.

Features

Why leading financial institutions choose Checkr Trust.

Checkr Trust powers over 10 million user screens every month using the industry’s most comprehensive criminal, public record, and identity data. It’s high-signal risk intelligence delivered through flexible APIs and tailored to your policies.

mainstream populations

TO 1 %

Check types

The Know Your Customer risk stack for financial institutions.

Checkr Trust delivers real-time insights from multiple layers of customer risk—criminal, watchlist, and identity data—all through one flexible integration. Built for KYC, KYB, BSA, AML, CIP, and CDD compliance.

National Criminal Database

Surface prior convictions tied to fraud, theft, and financial crimes from 650M+ public records across courts, corrections, and more.

Global Watchlists

Screen individuals against FBI, OFAC, Interpol, and other domestic and international watchlists to maintain compliance and block high-risk actors.

Identity Checks

Match submitted identity info to 9B+ verified records to confirm legitimacy, catch synthetic or fake identities, and prevent fraud—no document upload required for most users.

Biometric and Document Verification

Protect high-risk, high-value transactions by stopping impersonation, deepfakes, and identity spoofing. Add selfie-to-ID verification with a 99% detection rate and near-zero false positives.

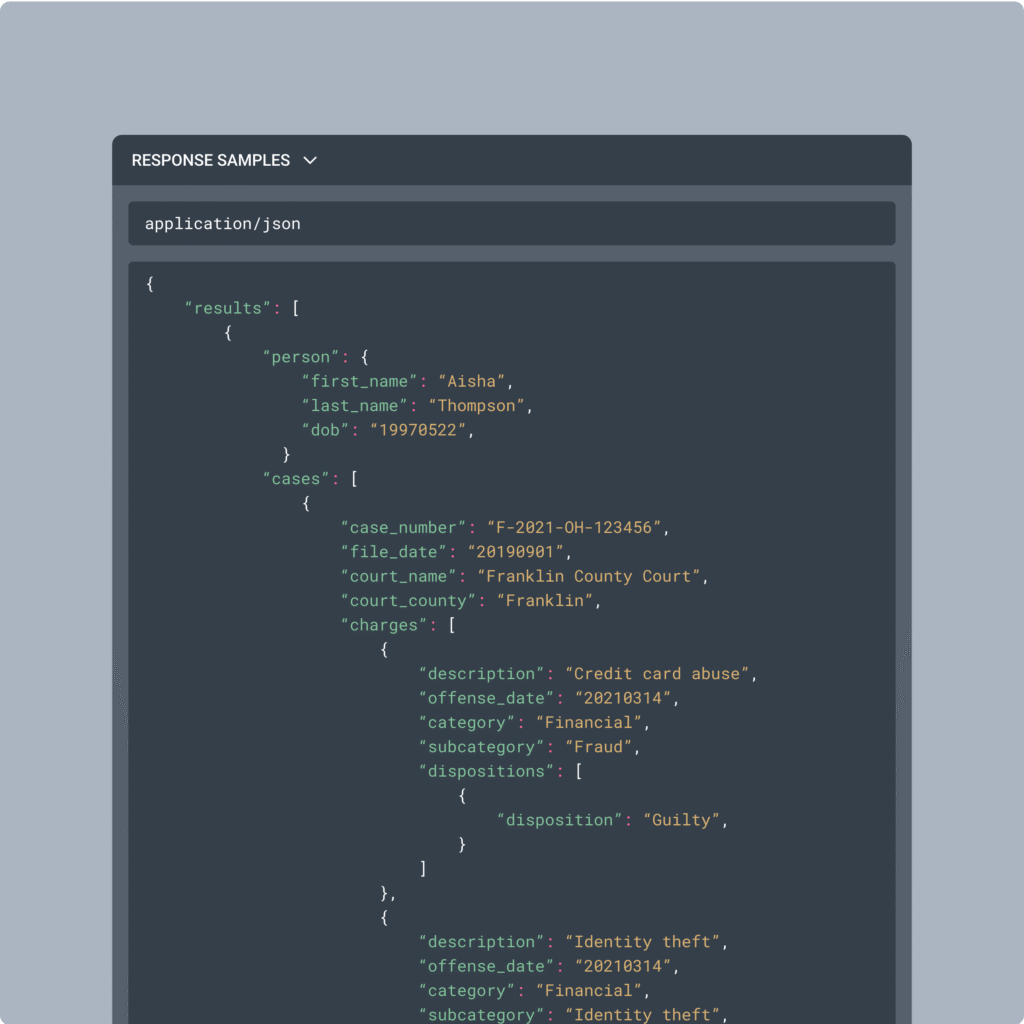

API

Real-time risk intelligence, built into your workflows.

Checkr Trust integrates with your platform via API to deliver real-time insights on identity, criminal history, and watchlist data. Build custom flows that match your risk thresholds without slowing customer acquisition.

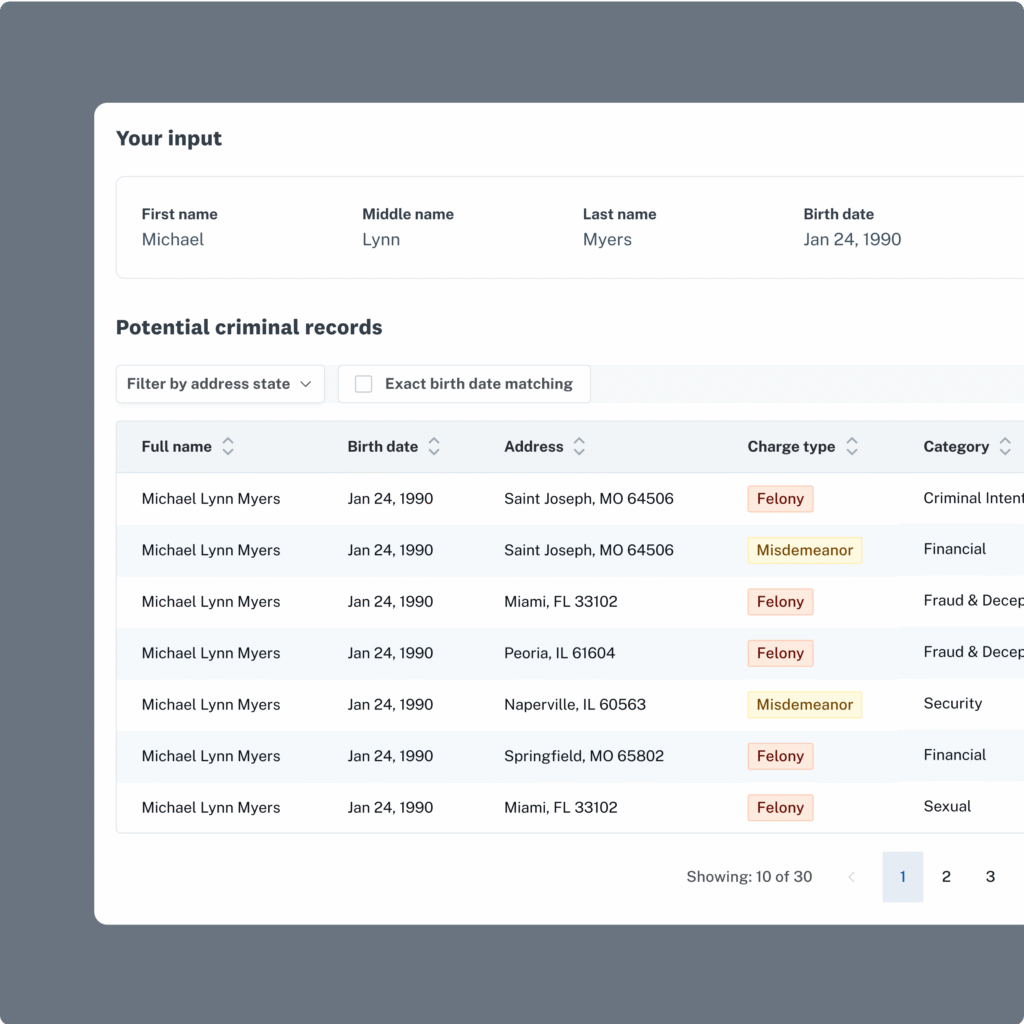

Dashboard

Screen in minutes, with no integration needed.

Whether you’re investigating a single user or screening in batches, our dashboard gives you instant access to criminal record and identity checks, with no engineering support needed.

Explore the latest insights on customer risk intelligence.

Ready to protect revenue by screening for more than identity?

Get a live walkthrough to see how Checkr Trust can help you reduce fraud and loss, meet compliance standards, and protect critical revenue streams.