Checkr Trust helps you turn data into confidence. Make informed decisions quickly to minimize risk and enhance compliance.

Why it matters

Traditional methods aren’t enough to mitigate insurance fraud.

While identity checks confirm who someone is, they don’t reveal past behaviors. Many fraud instances involve individuals with prior offenses. By integrating real-time criminal and driving data, and our other bespoke fraud signals into your assessment process, Checkr Trust helps you reduce fraud and safeguard revenue.

Features

Why leading insurers choose Checkr Trust.

Checkr Trust delivers over 10 million screenings monthly, utilizing comprehensive criminal, driving, and identity data alongside our bespoke fraud signals. This high-signal intelligence helps insurers manage risk effectively and streamline operations.

mainstream populations

TO 1 %

Check types

The Know Your Applicant risk stack for insurers.

Checkr Trust integrates multiple layers of risk data, including criminal records, watchlists, identity verification, driving records, and bespoke fraud signals, always ensuring compliance with regulatory standards.

National Criminal Database

Surface prior convictions tied to fraud, theft, and financial crimes from 650M+ public records across courts, corrections, and more.

Global Watchlists

Screen individuals against FBI, OFAC, Interpol, and other domestic and international watchlists to maintain compliance and block high-risk actors.

Identity Checks

Match submitted identity info to 9B+ verified records to confirm legitimacy, catch synthetic or fake identities, and prevent fraud—no document upload required for most users.

Biometric and Document Verification

Protect high-risk, high-value transactions by stopping impersonation, deepfakes, and identity spoofing. Add selfie-to-ID verification with a 99% detection rate and near-zero false positives.

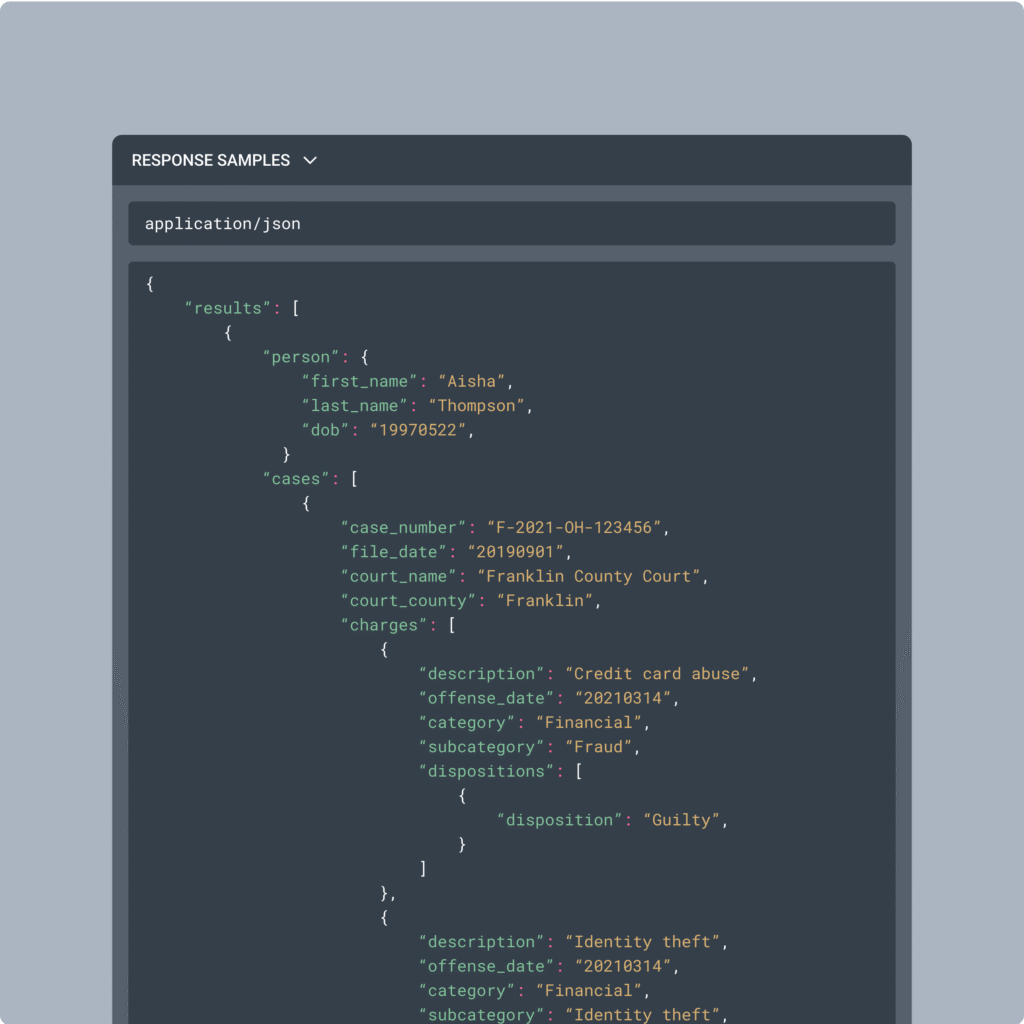

API

Real-time risk intelligence, built into your workflows.

Checkr Trust integrates with your platform via API to deliver real-time insights on fraud, identity, criminal history, driving history, and watchlist data. Build custom flows that match your risk thresholds without slowing customer acquisition.

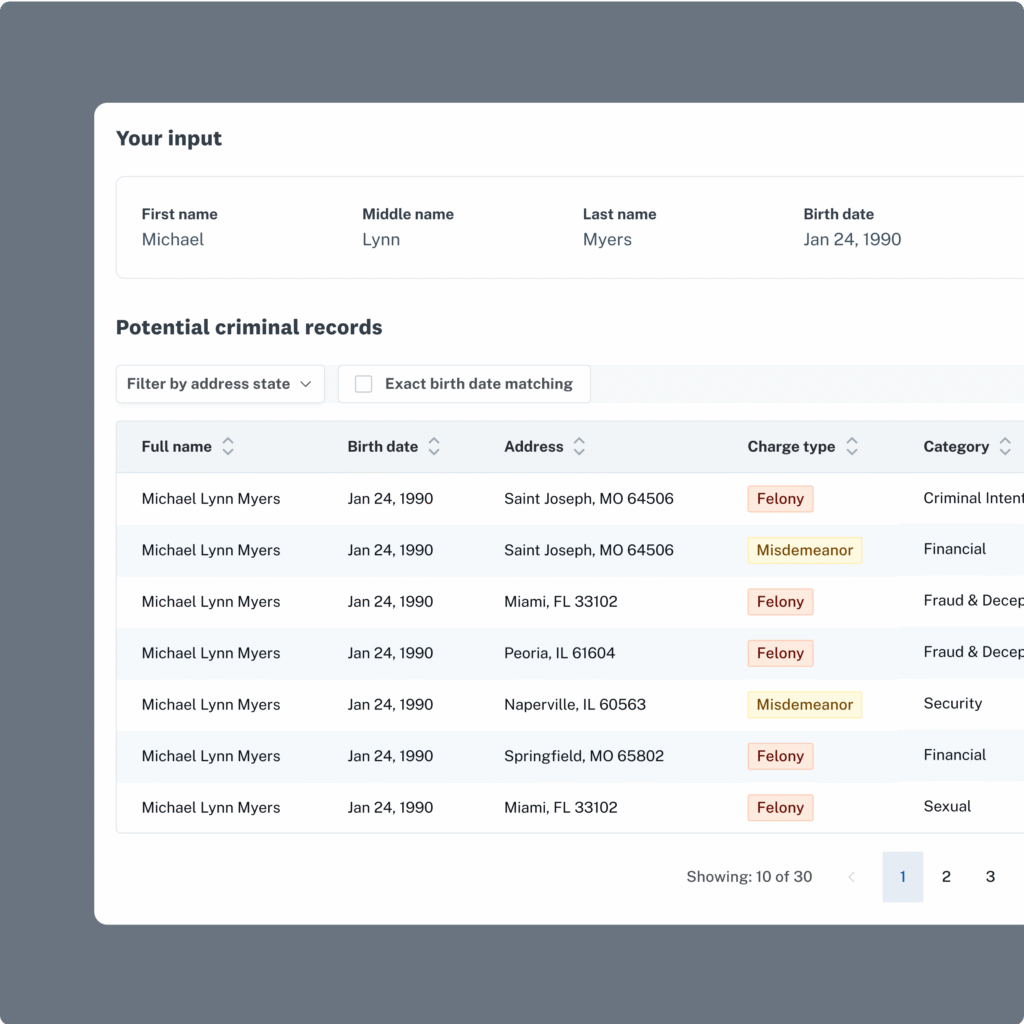

Dashboard

Screen in minutes, with no integration needed.

Utilize our dashboard to perform quick assessments without technical support, saving time and resources.

Explore the latest insights on customer risk intelligence.

Ready to optimize your underwriting and claims?

Get a live walkthrough to see how Checkr Trust can help you reduce fraud and loss, meet compliance standards, and protect critical revenue streams.